The Strategic Imperative of Diversifying Revenue Streams in Life Sciences

As the life sciences industry faces increasing competition and looming patent cliffs, CFOs of small and mid-cap pharma and biotech companies are prioritising diversifying revenue streams. This strategic shift aims to mitigate risks, unlock growth opportunities, and drive innovation. From investing in digital health technologies to forming alliances with tech and diagnostic companies, in 2025 diversification is essential.

New! Listen to the article as podcast!

Why Diversifying Revenue Streams Matters

Relying solely on core products exposes companies to risks such as patent expirations, market disruptions, and economic downturns. Diversification spreads these risks, offering a safety net and paving the way for growth.

Key benefits include:

- Risk Mitigation: Ensures business continuity when one revenue stream underperforms.

- Market Expansion: Opens doors to new geographies, customer segments, and innovative business models.

- Innovation Enablement: Drives creative solutions that address evolving healthcare needs.

- Increased Revenue Stability: Creates a sustainable foundation for long-term profitability.

However, successful diversification requires strategic planning, resource allocation, and operational agility—all of which benefit from ERP integration.

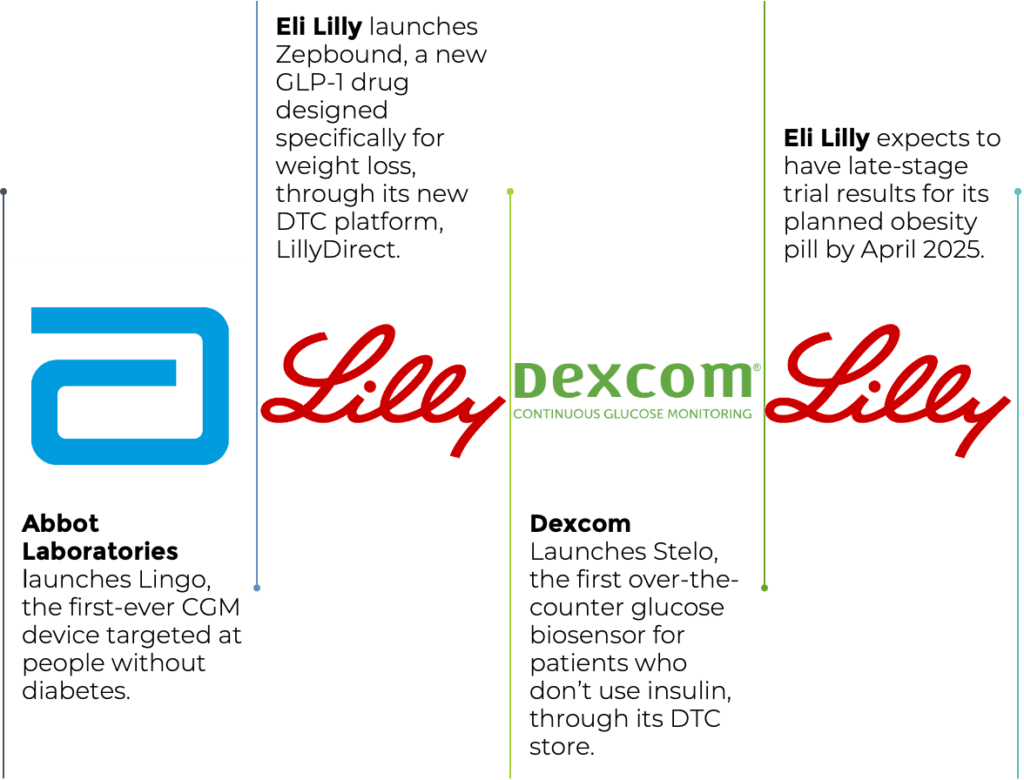

Diversifying Revenue Streams in Life Sciences: 4 examples of successful transformations in 2024.

Diversification Strategies for CFOs

1. Embracing Digital Health Solutions

Digital health technologies like telemedicine, remote patient monitoring, and software-driven care models are revolutionizing patient outcomes. Partnering with tech firms allows biopharma companies to monetize data and offer personalized care solutions, creating new revenue streams beyond traditional drug sales.

2. Licensing Agreements and Asset Divestitures

Licensing intellectual property or divesting non-core assets generates immediate capital while reducing operational complexity. These strategies enable CFOs to reinvest in high-potential areas like personalized medicine and advanced therapeutics.

3. Collaborations and Joint Ventures

Strategic alliances with diagnostic and tech companies foster access to cutting-edge technologies and markets. For example, collaborating on AI-driven diagnostics enhances treatment precision while generating shared revenues.

4. Expanding into Emerging Markets

Emerging markets present opportunities to meet unmet medical needs. While entry requires tailored strategies, the potential for revenue growth outweighs the risks.

5. Leveraging ERP Solutions for Diversification

Modern ERP systems are critical tools enabling CFOs to efficiently plan, predict, and manage diversified revenue models. These systems provide the infrastructure needed to ensure financial resilience while capitalising on new opportunities. Modern ERP systems are indispensable in managing diversified portfolios and support CFOs in navigating complexity:

- Accounting Accuracy: Tracks multiple revenue sources and ensures compliance with global financial regulations.

- Forecasting and Analytics: Provides insights to predict market trends and optimize resource allocation.

- Process Automation: Streamlines operations to reduce costs and improve efficiency.

- Scalability: Adapts to evolving business needs, supporting growth across geographies and therapeutic areas.

Overcoming Challenges

While diversification offers immense potential, it also introduces complexities:

- Resource Allocation: CFOs must strike a balance between funding core operations and exploring new ventures.

- Operational Complexity: Managing multiple revenue streams requires robust processes and skilled teams.

- Brand Integrity: Diversification must align with the company’s values and mission to maintain trust.

ERP systems address these challenges by integrating workflows, enhancing visibility, and supporting data-driven decision-making.

#GOATConsultants™-Level Insights:

Diversifying revenue streams is a proactive strategy for CFOs aiming to secure their company’s future in a competitive landscape. By exploring digital health, licensing, asset divestitures, and other innovative avenues, biopharma companies can achieve financial stability and drive growth.

Modern ERP solutions like SAP Business One are invaluable in this journey. These systems provide the tools needed to plan, predict, and capitalise on diverse opportunities while ensuring operational efficiency.

Take the next step in your company’s financial transformation by integrating a robust ERP system and embracing diversification.

Ready to Diversifying Revenue Streams in Life Sciences?

Contact us at #GOATConsultants™ for tailored solutions that deliver measurable results

Make the most of 2025 with our Key Financial Focus Articles.

- Latest News On Tariffs In Life Sciences

- Trump’s Biotech Policy Is Reshaping Global Science and Pharma Supply Chains

- Tariff Exemptions in Life Sciences – A Closer Look at the April 2025 Update

- Licensing Agreements In Life Sciences Amidst Trade Wars and Regulatory Shifts

- Tariff War In Life Sciences: How to Manage Customs Risks and Costs

- Medicine Shortages in the EU: Root Causes and Strategic Solutions

Learn more about financial management in the life sciences.

- Mastering Licensing Agreements Financial Management for Life Sciences Success

- Is Finance The Weak Link in Biotech Innovation?

Explore how digital solutions can enhance operations to drive innovation and growth in small and mid-tier life sciences: Change Management and Innovation page.

For more information on accounting norms, visit:

Financial Accounting Standards Board (FASB) – www.fasb.org

International Financial Reporting Standards (IFRS) – www.ifrs.org