How CFOs Turn ERP into a Value Engine in Life Sciences (Instead of a Dread Project)

ERP in life sciences doesn’t fail because of software; it fails when boards treat it as an IT upgrade instead of an operating‑model decision. This article outlines a practical 5‑step framework for life sciences ERP systems that ties Phase 0, governance and culture directly to cash, risk and growth. Built for biotech, pharma and medtech leaders driving pharma digital transformation and operational resilience.

Future of the Workplace: Reinventing Organizations for Life Sciences Leaders

Traditional HR practices are eroding trust in life sciences. Job descriptions overflow with buzzwords, encouraging candidates to tailor CVs to match the jargon instead of showcasing authentic skills. Employer branding often leans on empty slogans, disconnecting people from purpose. The outcome is predictable: recruitment processes that hire for appearances, not outcomes, and cultures where exaggeration and distrust take root. For biotech, pharma, and medtech leaders, the solution is clear — redefine HR by linking every job description, interview, and talent decision directly to business impact across quality, regulatory, and digital transformation.

Employee Engagement Crisis: Europe’s Workplace Revolution

Only 13% of European employees feel engaged at work, costing billions in productivity. This article unpacks the crisis and offers a bold roadmap for change.

VAT Compliance Failures Nearly Cost Biotech Millions

A biotech firm almost lost its license deal due to VAT compliance failures and internal miscommunication. We stopped two investigations and protected future revenue.

Biotech customs compliance: How we saved €800K in life-saving medicine

A biotech firm’s €800K shipment of life-saving medicine was stuck in French customs due to internal missteps. Here’s how we recovered it and kept patients safe.

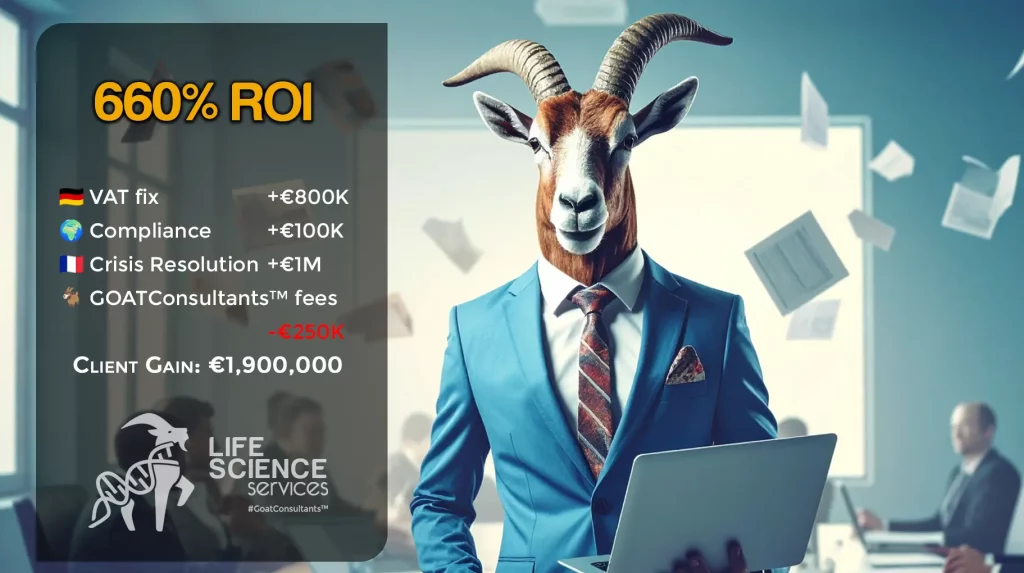

VAT Compliance As An Asset: How We Turned €250K into €1.9M – 660% ROI

#GOATConsultants™ turned €250K into €1.9M for a life sciences client by fixing VAT, eliminating invoicing inefficiencies, and resolving a €1M regulatory crisis.

What AI Can’t Do In An ERP Migration

What AI Can’t Do In An ERP Migration? AI can crunch data fast but it can’t align teams, resolve conflicts, or drive adoption. That’s where an ERP Transition Manager steps in. They translate chaos into clarity, bridging strategy and execution to ensure your ERP upgrade actually delivers.

You cost a Customer One Million Euro in VAT penalty

A €1M VAT penalty in France nearly cost a leading radiation therapy supplier its client and reputation. By rapidly fixing VAT number controls, aligning INTRASTAT and VAT filings, and automating compliance in ERP, the penalty was canceled and trust restored—proving that robust tax controls are essential for international business.

How we cut €100K/year in VAT compliance costs

A global radiation therapy leader slashed €100K/year in VAT compliance costs by replacing manual Word invoices with automated, ERP-driven workflows. Discover how deep data analysis, scenario-based invoicing, and digital transformation delivered audit-ready, regulator-approved results across seven EU countries—turning compliance chaos into capital.

How we recovered €800K from German VAT authorities

When €800K in German VAT was declared unrecoverable by a Big4 firm, we challenged the decision and won. Here’s how we traced the error, built our case, and redesigned our client’s in the medtech sector indirect tax process to prevent it from happening again.

Latest News On Tariffs In Life Sciences

The latest news on tariffs in life sciences reveals rising costs, policy risks, and innovation threats. Here’s what executives must know, and do, to stay ahead.

Trump’s Biotech Policy Is Reshaping Global Science and Pharma Supply Chains

Trump’s biotech policy is reshaping global pharma through tariffs, pricing reforms, and reshoring mandates. It is forcing life sciences leaders to rethink innovation, supply chains, and strategy.

Tariff Exemptions in Life Sciences – A Closer Look at the April 2025 Update

🚨 Tariff Exemptions in Life Sciences

❌ Trade policy is failing U.S. pharma & biotech manufacturing.

✅ 60% of pharma inputs & medicines are now tariff-exempt.

❌ But when considering the entire life sciences industry, that number drops to 40%.

🔻 What’s missing?

❌ Medical devices are NOT included.

❌ Manufacturing equipment (CAPEX) is still taxed.

❌ Key biomanufacturing consumables face tariffs.

💡 The biggest contradiction?

Trump’s administration says it wants to “re-arm” U.S. industry—but tariffs still apply to the equipment needed to manufacture medicines here.

👉 How can companies bring production back if CAPEX remains expensive?

📢 What needs to change?

🔹 Exempt medical devices & biotech consumables.

🔹 Eliminate CAPEX tariffs to allow true reshoring.

🔹 Create a comprehensive trade policy for ALL life sciences.

Right now, this isn’t an industrial revival—it’s a half measure.

Licensing Agreements In Life Sciences Amidst Trade Wars and Regulatory Shifts

The Great Rollback is disrupting licensing agreements in life sciences as trade wars and regulatory fragmentation create uncertainty. FDA instability is delaying approvals, causing licensing disputes, while U.S. export controls are forcing European biotechs to reconsider partnerships. To mitigate risks, companies are embedding ‘trade war triggers’ and arbitration clauses in agreements. Meanwhile, the EMA’s regulatory stability offers a strategic advantage, enabling U.S. and Chinese firms to prioritize Europe for faster approvals and market entry. The future of licensing will depend on adaptability, geopolitical foresight, and leveraging EMA’s reliability.

Tariff War In Life Sciences: How to Manage Customs Risks and Costs

The U.S.-EU tariff war is raising costs and tightening customs scrutiny for pharmaceuticals, medical devices, and IMPs. With 25% tariffs on exports, companies can no longer rely on nil-value declarations for clinical trial shipments, risking higher costs, delays, and compliance issues. To navigate this, firms must adopt ERP-driven customs management, ensuring accurate HTS classification, tariff tracking, and duty mitigation to protect supply chains and control costs.

Medicine Shortages in the EU: Root Causes and Strategic Solutions

Medicine shortages in the EU are not a new challenge, yet they continue to disrupt healthcare systems and patient care worldwide. Over 50% of these shortages stem from manufacturing and quality issues, exacerbated by fragmented supply chains, inadequate data management, and reactive crisis handling.

This article dissects the root causes of medicine shortages and offers practical, data-driven solutions for life sciences companies. From strengthening supply chain resilience to leveraging modern ERP systems for early risk detection, we explore how small and mid-tier pharma companies can move from crisis response to proactive prevention.

The key to solving medicine shortages? Organized data, structured processes, and strategic action. Read on to discover how the right approach can transform uncertainty into stability.